Approximately two out of every three families are in debt in Brazil.

In March, 66.2% of families were in debt (practically two out of every three of them). According to research released this Monday (30) by the National Confederation of Commerce of Goods, Services and Tourism (CNC).

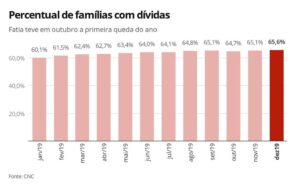

This is simply the highest percentage in the survey's historical series, which began in January 2010. The record until then had been registered in December 2019, when the percentage reached 65.6%.

The indicator encompasses several factors within the “debt” category, such as, for example, commitments made with post-dated checks, credit cards, overdrafts, store credit cards, personal loans, car payments and insurance.

This survey shows that defaults also increased in March. The percentage of families with overdue bills or debts rose from 24.1% in February to 25.3% in March.

While the total number of families that declared that they were unable to pay their bills or overdue debts and that, therefore, they would remain in default rose for the 2nd consecutive month, rising to 10.2%, compared to 9.7% in February.

National Confederation of Trade in Goods, Services and Tourism

“The data for this Peic was collected between February 20 and March 5, before the week in which the COVID-19 pandemic spread in Brazil. Even so, there was a worsening in default indicators, which will likely worsen in the months ahead, as consumers will likely find it more difficult to pay their bills on time,” noted the CNC.

Izis Ferreira, the economist responsible for the research, also draws attention to the average portion of income committed to debts. This reached 30% in the third month of this year. As well as to the proportion of families that declared themselves to be heavily in debt. This increased from 15% in February to 15.5% in March.

“Almost a third of family income is committed to debt, the highest percentage since December 2017. In families with incomes of up to ten minimum wages, income commitments have grown more significantly in the last three months,” he highlights.

For more information on the economy, access.